Free Car Valuation Tool

Valuation Complete: How to Use This Number to Slash Your Insurance Premium

The estimate above reflects your vehicle’s Actual Cash Value (ACV) in the live Canadian market. While seeing this number is interesting, using it strategically is how you save money.

Most drivers in Ontario, Alberta, and British Columbia are currently overpaying for their auto insurance. Why? Because their premiums are often calculated based on “Ghost Value”—the price they paid for the car years ago, not what it is worth today.

If your vehicle has depreciated significantly, but your insurance premium has kept rising, you are likely paying for coverage that will never pay out. This guide will show you exactly how to use your new valuation estimate to audit your policy, negotiate with brokers, and find the cheapest car insurance rates available in 2025.

The “Depreciation Trap”: Why You Are Overpaying

Insurance is a product based on risk and replacement cost. When you buy a brand new car for $40,000, the insurer charges you a premium commensurate with the risk of replacing a $40,000 asset.

However, cars depreciate faster than any other major asset. Within five years, that car might be worth only $15,000. The problem is that unless you intervene, many insurance policies simply roll over, charging you a premium that doesn’t fully reflect this drop in liability for the insurer.

Your goal is to align your premium with the Actual Cash Value you just calculated. If there is a gap, there is room for savings.

3 Strategic Ways to Use Your Valuation Estimate

Now that you have the data from our tool, here are the three specific financial moves you should make immediately.

1. The “10% Rule” for Collision Coverage

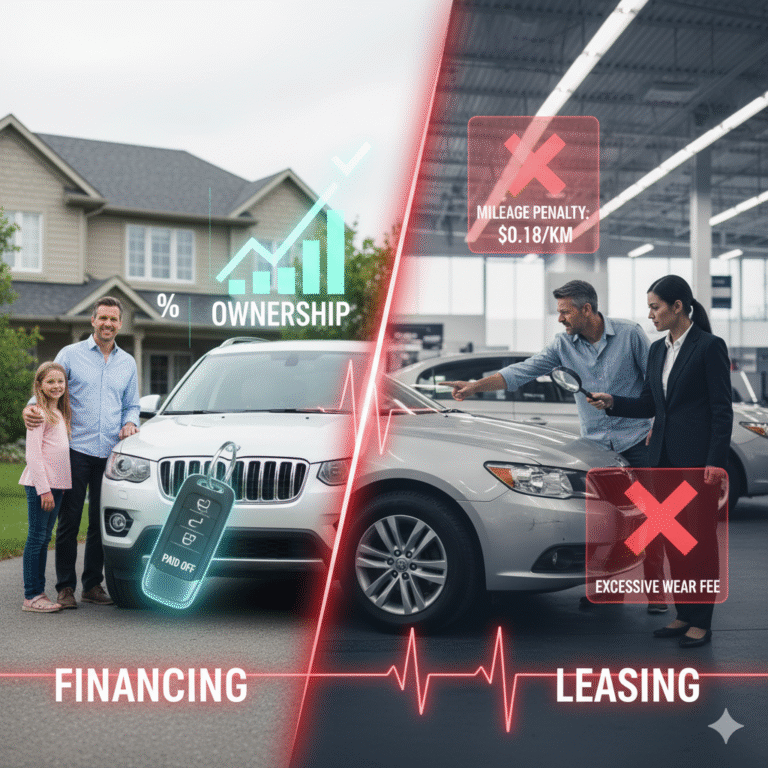

This is the most common place money is wasted. Collision Coverage pays to repair or replace your own car if you are at fault in an accident. It is optional (unless your car is leased/financed).

The Rule: If your annual cost for Collision and Comprehensive coverage is more than 10% of your car’s total value, it is often financially wiser to drop it.

- Example: You drive an older Honda Civic. Our tool estimates its value at $4,000. Your insurance bill shows you are paying $600/year just for the “Collision” portion of your policy.

- The Math: You are paying $600 to protect a maximum payout of $4,000 (minus a likely $1,000 deductible). That means your real maximum payout is only $3,000.

- The Move: In this scenario, switching to “Liability Only” coverage could save you hundreds of dollars instantly.

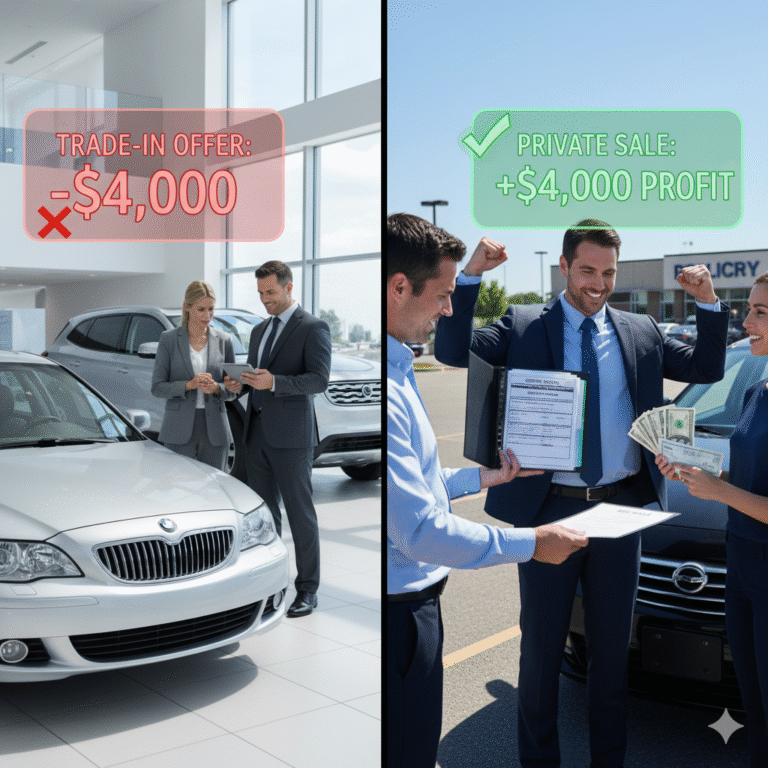

2. Negotiating the “Total Loss” Payout

If you are ever in an accident and your car is written off (declared a total loss), the insurer will offer you a settlement based on their assessment of the market value. Often, their initial offer is low.

By saving the estimate from our tool (or using it annually), you have a baseline of market data. While our tool is an estimate, it provides the confidence to contest lowball offers. Knowing your asset’s worth is the only leverage you have against an adjuster’s spreadsheet.

3. Anchoring Your Shopping Process

When you compare online car insurance quotes, you will be asked for vehicle details. Having an accurate sense of the car’s value helps you choose the right deductible. If you know the car is low-value, you can comfortably raise your deductible to $1,000 or $2,000, which drastically lowers your monthly premium.

Deep Dive: Understanding Your Canadian Policy Coverage

To extract the maximum eCPM (and value for you), we need to break down the technical components of your bill. Understanding these terms helps you know exactly what to cut and what to keep.

Mandatory Coverage (The Non-Negotiables)

You cannot legally drive in Canada without these. Do not try to cut costs here, as it exposes you to bankruptcy risk.

- Third-Party Liability: This covers you if you hurt someone else or damage their property. The minimum is often $200,000, but in today’s litigious society, $1 Million to $2 Million is the standard recommendation.

- Accident Benefits: This covers medical costs, rehabilitation, and loss of income for you and your passengers, regardless of who caused the crash.

- Direct Compensation – Property Damage (DCPD): In provinces like Ontario, Alberta, and Nova Scotia, this covers damage to your car if someone else hits you. It is called “Direct Compensation” because you deal with your own insurer, not the other driver’s.

Optional Coverage (Where the Savings Are)

This is where your valuation number matters most.

- Collision Coverage: Covers your car if you hit a pole, a wall, or another car (and you are at fault).

- Comprehensive Coverage: Covers non-collision events like theft, fire, hail, vandalism, or hitting a deer.

- Specified Perils: A cheaper, stripped-down version of Comprehensive that only covers specific risks named in the policy (like fire or theft), but not others (like vandalism).

5 Pro-Tips to Lower Your Premium Today

Beyond knowing your car’s value, here are five actionable ways to force your premium down.

1. The “Bundle” Discount This is the easiest win. Moving your Home or Tenant Insurance to the same provider as your Auto Insurance usually triggers a “Multi-Line Discount” of 15% to 25%. It is often cheaper to have two policies with one company than one policy with two different cheap companies.

2. Raise Your Deductible The deductible is what you pay out-of-pocket before insurance kicks in.

- $500 Deductible = Higher Monthly Premium.

- $1,000 Deductible = Lower Monthly Premium. If you have an emergency fund, raise your deductible. You are essentially “self-insuring” the small scratches to save on the big bill.

3. Usage-Based Insurance (Telematics) If you are a safe driver or you have a short commute, ask about Telematics. This involves using a mobile app or a device in your car to track your driving habits (braking, speed, time of day).

- The Benefit: Good drivers can see discounts of up to 25% upon renewal.

- The Risk: In some provinces, bad driving data can lead to surcharges, so only do this if you are a calm driver.

4. The “Winter Tire” Discount In Ontario, insurers are legally required to offer a discount for winter tires (usually 2-5%). In other provinces, it is a common perk. Make sure your insurer knows you have winter tires installed during the season.

5. Shop Around Annually Insurance rates are not static. They change based on the insurer’s total pool of losses in your postal code. One company might raise rates in Brampton while another lowers them. Use comparison sites to get multiple auto insurance quotes every year, about 30 days before your renewal. Loyalty implies you are not price-sensitive, and insurers will capitalize on that.

Frequently Asked Questions (FAQ)

Does my credit score affect my car insurance rate? In many Canadian provinces (excluding Newfoundland and Labrador, and with restrictions in Ontario), insurers can use your credit score as a risk factor. Maintaining a high credit score can directly lead to cheaper insurance premiums, as data shows a correlation between financial stability and fewer claims.

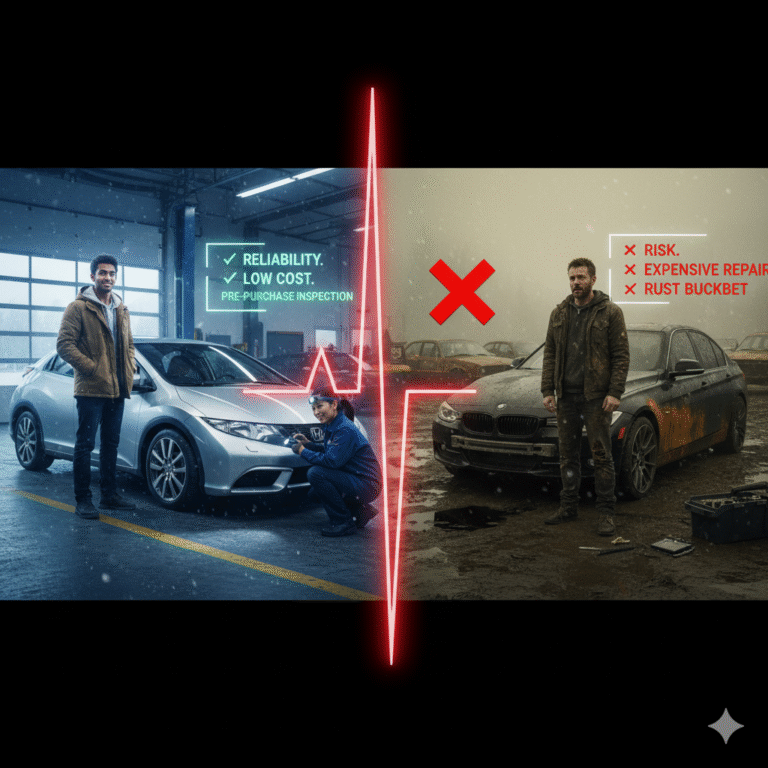

Is it cheaper to insure a new or used car? Generally, a used car is cheaper to insure because the replacement cost (ACV) is lower. However, very old cars might lack modern safety features (like automatic braking), which can slightly increase the premium for Accident Benefits. The “sweet spot” for low insurance is often a safe, used vehicle that is 5-7 years old.

What is a “High-Risk” driver? If you have multiple traffic tickets, at-fault accidents, or a cancellation for non-payment, you may be labeled “High Risk.” This forces you into the “Facility Association” or specialized insurers like Pafco or Echelon, where rates can be double or triple the standard market price. The only cure is time and a clean driving record.

Data is Your Leverage

The days of blindly paying your renewal bill are over. By using the Free Car Valuation Tool, you have taken the first step toward financial transparency.

Your car is a depreciating asset. Your insurance bill should reflect that reality. Take the estimate you generated today, review your coverage limits, and shop the market. The difference between a passive customer and an informed one can be thousands of dollars over the life of your vehicle.

Final Action: Scroll up, note down your estimated value, and click on a comparison option to see if you can beat your current rate today.

2 Comments

Comments are closed.