Flagged Address? Save Your Account

The 2026 Reputation Recovery Manual

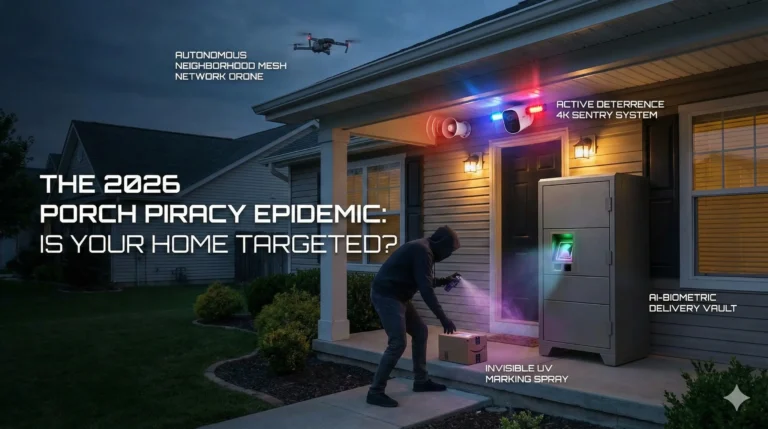

Your home address is no longer just a physical location; in 2026, it is a digital reputation score. E-commerce giants now use complex algorithms to track “risk events” associated with every doorstep in the United States. If your packages keep disappearing, you aren’t just losing items—you’re losing your standing as a trusted consumer.

(Clicking these buttons will take you to this same website)

Once an address is “flagged,” the standard customer service experience vanishes instantly. You face automated denials, ignored claims, and the looming threat of a permanent account ban. This isn’t just a glitch; it’s a systematic blacklisting of your residential identity that can cut you off from essential services.

You cannot afford to be locked out of the digital economy. Recovering your standing requires a technical, high-performance approach to rehabilitate your “Trust Score” before the system shuts you out for good. Discover the exact steps to clear your name and secure your future orders. Learn more below.

The Invisible Shadow Ban of 2026

In the current landscape, retailers like Amazon and Walmart have moved beyond simple tracking. They now utilize “Predictive Risk Modeling” to determine if a customer is “too expensive” to keep. If your neighborhood or specific home has a high rate of reported thefts, you are a liability.

This “Shadow Ban” doesn’t come with a warning email or a notification. It manifests as a sudden inability to process returns or an increase in “Inquiry Pending” statuses. The system is essentially waiting for one more excuse to close your account permanently.

Understanding Your Residential Trust Score

Every transaction you make contributes to an internal “Trust Score” linked to your address. This score factors in your delivery success rate, return frequency, and even your neighbor’s data. High-volume shoppers are watched more closely because their potential for loss is statistically higher.

When a package is stolen, the algorithm doesn’t blame the thief; it logs a failure against the address. Multiple failures trigger a “High-Risk” flag that overrides your years of loyal spending. Understanding this cold, mathematical logic is the first step toward beating the machine.

Red Flags: Is Your Account Already Targeted?

There are subtle technical indicators that your account is currently on the retailer’s radar. Check if your “Instant Refund” options have been replaced by a mandatory 30-day waiting period. This is a sign that the automated system no longer trusts your word and requires manual verification.

Another red flag is the requirement of a police report for low-value items under $50. Standard accounts usually bypass this for small claims as a gesture of goodwill. If you are being forced into legal paperwork for minor issues, your address is officially “Flagged.”

The Professional Account Rehabilitation Manual

To save your account, you must stop acting like a victim and start acting like a security professional. The goal is to provide the algorithm with so much “Clean Data” that it is forced to reset your risk level. Follow these five high-performance steps to rebuild your reputation from the ground up.

Step 1: Overloading the System with Proof

The algorithm thrives on ambiguity; you must counter it with absolute, undeniable clarity. For every single delivery, even the successful ones, upload a photo of the package on your porch. This creates a “Success Trail” in your account history that the human reviewer cannot ignore.

If a theft occurs, don’t just send a message; provide a timestamped video file. Show the delivery, the gap in time, and the theft itself from multiple camera angles. This “Evidence Overload” makes it legally and technically difficult for the bank or retailer to deny you.

Step 2: The “Safe Zone” Reset Strategy

The fastest way to stop the “Risk Event” cycle is to remove your home address from the equation. For the next 60 days, redirect 100% of your orders to an Amazon Locker or a UPS Access Point. This provides the system with a “Perfect Delivery Streak” that is guaranteed by a secure location.

By using a verified locker, you are resetting the “Delivery Failure Rate” of your account profile. Once the algorithm sees two months of zero issues, it often relaxes the flags on your home address. It’s a strategic retreat that allows your “Trust Score” to heal in the background.

Step 3: Escalating to Executive Resolutions

Standard chat support agents have no power to remove an address flag or a shadow ban. You must escalate your case to the “Executive Resolutions” or “Account Health” departments. These specialized teams have the administrative access required to manually “White-List” a residence.

Use professional, non-emotional language when communicating with these high-level teams. State: “I am requesting a manual review of my account’s risk status following a localized security upgrade.” This signals that you are a high-value client taking proactive steps to protect the retailer’s assets.

Step 4: Sanitizing Your Digital Identity

Your account reputation is often linked to other “High-Risk” users via shared Wi-Fi or devices. If a family member or former roommate has a banned account, you are being “Stitched” to their risk. Ensure your Wi-Fi is password protected and that you aren’t using shared public hotspots for purchases.

Updating your “Secondary Identity” can also help—add a verified business phone number. Link a premium credit card (Amex or Chase) that has its own high-tier fraud protection. The bank’s reputation often “rubs off” on your account, providing an extra layer of perceived trust.

Step 5: Maintaining Long-Term VIP Standing

Once your account is rehabilitated, you must play the “Long Game” to stay in the green. Avoid the “Serial Returner” trap by only returning items that are truly defective or incorrect. Frequent “Change of Mind” returns are a primary trigger for account audits in 2026.

Leave positive feedback for every successful delivery to reinforce the positive data loop. In the eyes of the AI, a “High-Engagement, Low-Problem” user is a VIP worth protecting. Stay vigilant, keep your security hardware updated, and never let your Trust Score drop again.

Final Thoughts on Digital Reputation

In 2026, your ability to participate in the economy depends on your digital standing. An empty porch is a logistical failure, but a banned account is a lifestyle catastrophe. By treating your account reputation as a professional asset, you ensure your future access to the world.

Frequently Asked Questions

1. Can I just open a new account if mine is flagged? No. Retailers use “Fingerprinting” (IP, Device ID, and Address) to link new accounts to old ones. Opening a second account usually triggers a permanent ban for both for “Policy Circumvention.”

2. Does my credit score affect my retailer Trust Score? Not directly, but the type of card you use does. Premium cards provide more data to the retailer. A verified billing address on a high-limit card acts as a “Trust Signal” to the retailer’s algorithm.

3. Will a police report actually help my account status? Yes. It proves to the “Account Health” team that you aren’t committing “Friendly Fraud.” It is a formal legal document that forces the retailer to treat the loss as a legitimate crime.

4. How long does a “Shadow Ban” last if I do nothing? Unfortunately, residential flags can last for years because they are tied to the physical location. Action is required; you must provide “Clean Data” to force the system to update your status.

5. Can I be banned for my neighbor’s thefts? Potentially. Retailers use “Hyper-Local” risk mapping. If your Zip Code is a “Hot Zone,” the system is stricter. This is why using secure lockers or vaults is essential for residents in high-theft areas.